Market Pulse #2: Volatility Play - $25K to $2,500/Month

When most people hear the phrase high yield, they picture a bond paying 6–8%. Maybe a risky REIT or a dividend stock.

Right now, though, there are ETFs in the U.S. paying out 80–125% annualized yields. They don’t get those payouts from dividends or interest. Instead, they turn market volatility itself into income.

And two of the biggest engines driving these yields? MicroStrategy and Palantir.

MicroStrategy: The Bitcoin Vault That Became a Supermarket

Michael Saylor has turned MicroStrategy into something very different from its original software business. It’s now the world’s largest corporate holder of Bitcoin 632,457 BTC and counting.

To fund this, the company has issued a menu of securities:

MSTR common stock, the pure upside play.

STRK (8% preferred), STRF & STRD (10% preferreds), STRC (variable ~9%).

It’s like a financial supermarket tied to Bitcoin. Investors can choose growth (common stock), income (preferreds), or something in between.

But the wildest yields aren’t inside MicroStrategy itself. They come from ETFs that trade on top of it.

YieldMax: Turning Volatility Into Income

Most investors buy stocks because they want price appreciation. YieldMax ETFs approach things differently: they sell away potential upside in exchange for immediate cash flow.

The tool they use is called a covered call strategy. Here’s the simple version:

You own a volatile stock like MSTR or PLTR.

You sell call options, giving traders the right to buy that stock from you if it soars past a certain price.

In exchange, you collect large option premiums.

It’s a bit like renting out your house: you pocket rent each month, but if property prices suddenly double, you don’t benefit because you’ve already signed away that gain.

With stocks like MicroStrategy and Palantir, which swing wildly and attract huge trading interest, option premiums are enormous. That’s why the payouts look unbelievable often 80%, 100%, even 120% annualized.

MSTY – The MicroStrategy Income Machine

MSTY runs the covered call strategy on MSTR stock. Because MSTR is essentially leveraged Bitcoin, the options market around it is some of the richest in the world.

As of August 2025, MSTY’s annualized distribution rate was 92.6%. On a $25,000 position, that worked out to about $2,000 per month.

The tradeoff is that upside is capped. If MSTR doubles, MSTY won’t, because it’s already sold away those gains. This fund is for income, not growth.

ULTY – The Diversifier

ULTY spreads the same strategy across 15–30 volatile stocks.

Recent distribution rates hovered around 85–86%, or about $1,800 per month on $25,000 invested.

PLTY – Palantir on Steroids

PLTY focuses on Palantir Technologies (PLTR), one of the most option-hungry tech stocks in the market. Traders can’t get enough of betting on Palantir’s moves, and that demand drives option premiums sky-high.

The result? PLTY’s most recent distribution rate was 125% annualized. On $25,000 invested, that’s over $2,500 per month.

To put it plainly: PLTY is monetizing Palantir hype. The more traders gamble on PLTR’s options, the bigger the income stream PLTY can pass to holders.

Living Off Volatility

Here’s the math:

$25k in MSTY → ~$2,000/month

$25k in ULTY → ~$1,800/month

$25k in PLTY → ~$2,600/month

Total: around $6,500 per month from $75k invested.

Compare that to a traditional retirement portfolio, where a 4% withdrawal rate would give just $250 per month on the same $75k. The difference is staggering.

But Here’s the Catch

These payouts are not guaranteed. They exist because option premiums are inflated by volatility. That means:

If MSTR or PLTR skyrocket, you miss the gains, because you sold the upside.

If they crash, the ETFs fall too. The income cushions the blow but doesn’t eliminate it.

Distributions change month to month depending on volatility.

Much of the payout is classified as return of capital, meaning part of it is just your principal being handed back. Over time, if NAV erodes, your base shrinks.

Think of it like renting out Lamborghinis every weekend. Most weeks you get fat rental checks. But one bad weekend, and the car’s wrapped around a tree.

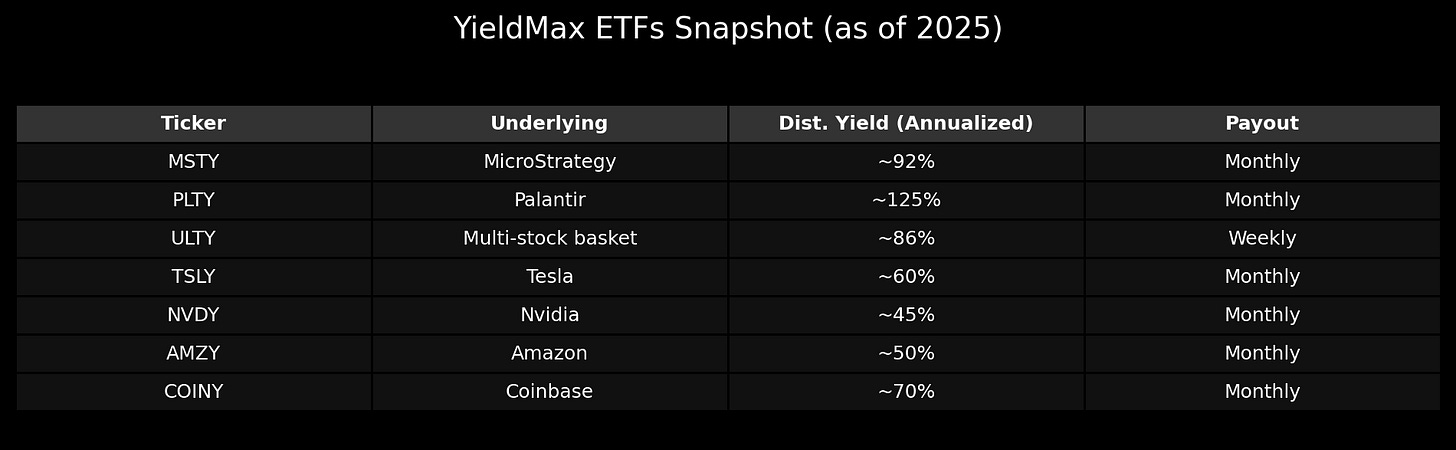

Beyond MSTR and PLTR

YieldMax has built a whole suite of these funds, not just MSTY, ULTY, and PLTY. There are versions tied to:

TSLY (Tesla)

NVDY (Nvidia)

AMZY (Amazon)

COINY (Coinbase)

and others.

They all run the same covered-call playbook. The difference is the yield: Tesla and Nvidia usually yield lower than MSTR or PLTR because their option markets aren’t quite as juiced. Still, they regularly post 40–70% distribution rates far higher than any traditional dividend fund.

Availability: U.S. vs Europe

Here’s the important detail most people miss: these ETFs are U.S.-listed and not UCITS-compliant. That means they’re generally available only to U.S. investors.

If you’re in Europe, you can’t buy MSTY or PLTY directly. The closest alternatives are UCITS-listed covered call funds, like:

Global X Nasdaq 100 Covered Call UCITS ETF (QYLD equivalent)

WisdomTree Enhanced Commodity UCITS ETFs (similar option-income strategies)

Various European high-dividend UCITS ETFs, though yields are far lower (typically 5–12%).

The mechanics are similar, but you won’t see anything near 100% yields in Europe. For now, the YieldMax “super-yield” products are a uniquely American phenomenon.

The Takeaway

High yield always comes at a cost. These products look like income machines, but what they’re really doing is trading tomorrow’s upside for cash today.

If you want growth, own Bitcoin or MSTR itself. If you want cash flow, funds like MSTY, ULTY, and PLTY are among the highest-yielding products in the world.

It works until it doesn’t.

Good Luck.