Edge Letter #1: I'm Stacking Sats To Retire 20 Years Early, Here's My Plan

HARSH TRUTH: You'll never achieve financial freedom following the same advice your parents did.

The traditional "work 40 years, save 10%, retire at 65" playbook is broken.

Inflation destroys your purchasing power while the cost of housing, healthcare, and education has exploded 300%.

Meanwhile, your parents' generation could buy a house for 2x their annual salary. Now it's 8x.

Their retirement advice? Worthless in 2025.

Disclaimer: This is not financial advice. I'm not a financial advisor, just someone exploring ideas around financial independence. Always do your own research.

The Path to Financial Freedom: It's More Achievable Than You Think

We’re told financial freedom is for unicorn founders and lottery winners. Not for people with $2,000 monthly paychecks.

I used to think the same way until I discovered "Early Retirement Extreme" book by Jacob Lund Fisker.

The FIRE (Financial Independence, Retire Early) concept in the book was an eye-opener for me. It revealed that ordinary people can achieve financial independence through a systematic approach.

If you're interested in diving deeper, I recommend checking out Jacob's work and the Mr. Money Mustache forum.

The Core Philosophy: Extreme Saving + Smart Investing

The approach is simple:

maximize your savings rate

invest everything in low-cost index funds.

The magic happens when you combine aggressive saving with the power of compound growth.

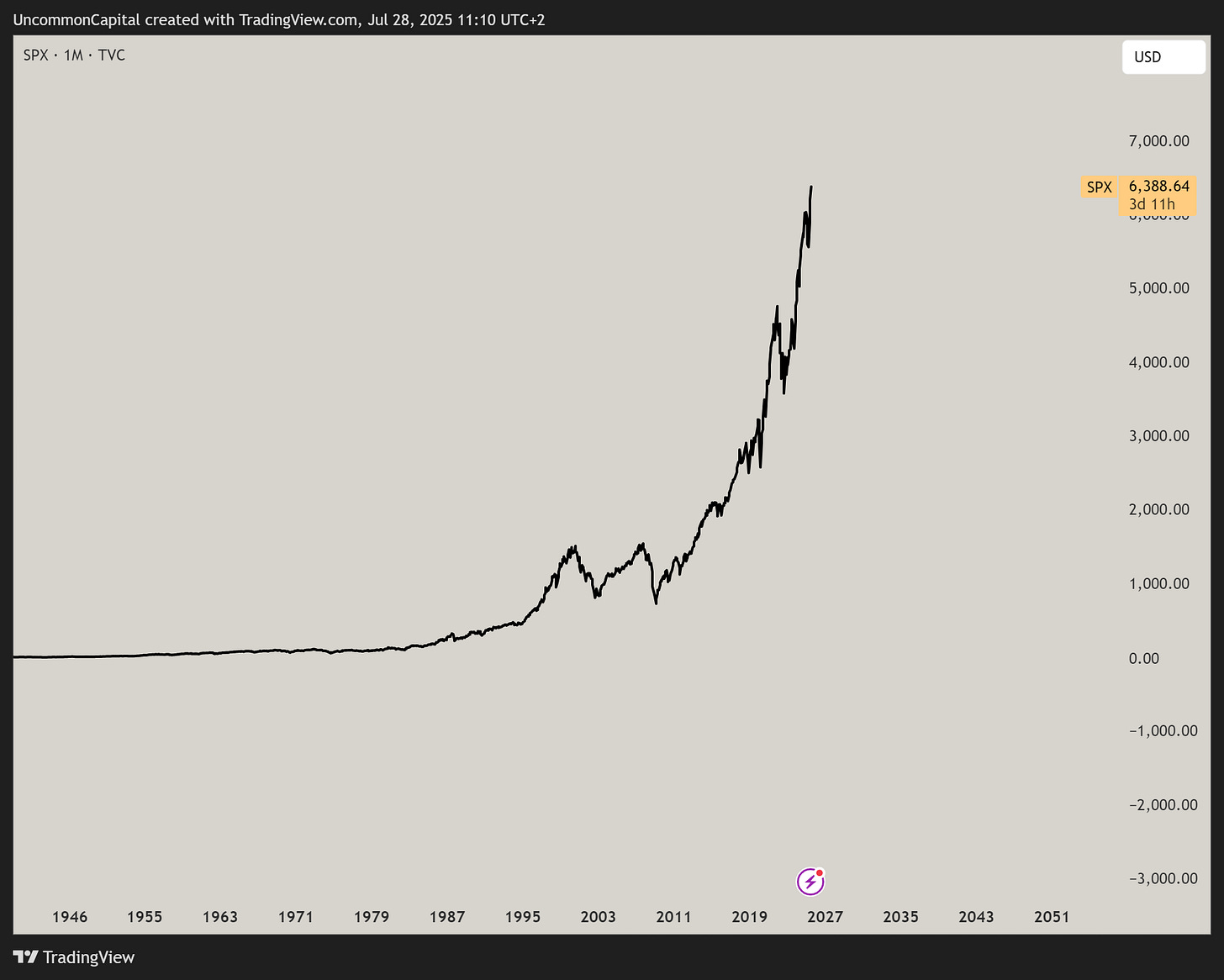

This is the chart of S&P500

Calculating Your Freedom Number

Financial independence isn't about accumulating endless wealth.

It's about having enough to cover your expenses without depending on a 9-5.

Here's the formula:

FIRE Number = Annual Expenses × 25

This is based on the 4% rule, which suggests you can withdraw 4% of your portfolio annually without depleting your principal.

Real-World Example

Let's say you want to maintain a $2,000 monthly lifestyle ($24,000 annually). Your FIRE calculation would be:

Annual expenses = $24,000 (your desired lifestyle)

FIRE Number = $24,000 × 25 = $600,000

Now, let's see how different monthly savings amounts affect your timeline to reach $600,000 (assuming 7% annual returns):

Save $1,000/month: 23 years

Save $1,500/month: 18 years

An extra $500 per month cuts 5 years off your journey to financial independence. The difference in monthly investment amounts makes a dramatic impact on your timeline.

The Real Goal: Freedom, Not Retirement

Here's the crucial point: this isn't about retiring to do nothing. Financial independence gives you the ultimate freedom.

The ability to pursue work you're passionate about without worrying about the paycheck.

You can start that creative project, volunteer for causes you care about, or choose jobs based on fulfilment rather than necessity.

A New Asset Class Changes Everything

Twenty-three years might seem like a long journey, but what if there was a way to potentially accelerate this timeline?

Enter the best-performing asset of the past and future decades. One that wasn't available to previous generations of savers.

Bitcoin.

Let's explore how incorporating it into your financial independence strategy might change the game...

Bitcoin Changes the FIRE Equation

So far, we’ve explored the traditional FIRE model. It focuses on saving and investing in low-cost index funds. Targeting an average annual return of 7%.

But what if we tried something different?

What if we swapped the traditional asset for the best-performing one from the last decade?

What is Different About Bitcoin?

Bitcoin is scarce by design. Unlike fiat currencies that lose purchasing power over time. There will only ever be 21 million BTC in existence.

Combine that with more institutions adopting it, public companies adding it to their treasuries, and spot ETFs, and you have a strong contender for a long-term store of value.

But let’s get into the numbers.

Understanding CAGR (Compound Annual Growth Rate)

Before we compare timelines, we need to understand CAGR - Compound Annual Growth Rate. It's a way to measure the steady yearly return of an investment, even if the asset's value changes a lot each year.

In simple terms: If Bitcoin grew at the same rate each year, what would that rate be?

Bitcoin’s historical CAGR

Over the last 10 years (2013–2023), Bitcoin's average CAGR has been ~104%.

Let that sink in.

Compare that to the S&P 500’s ~7–8% over the same period.

Even if we apply a much more conservative CAGR of 30%, it still dramatically changes the FIRE timeline.

Real-World Example: Bitcoin vs. Traditional FIRE

Quick note: Yes, comparing Bitcoin to the S&P 500 is like comparing a rocket ship to a Toyota. They're completely different risk profiles. But if you're willing to take on more risk for potentially massive acceleration, the numbers are wild.

Let’s reuse our example from before: Your FIRE target is $600,000, and you can save $1,000/month.

Here’s how long it would take depending on your investment strategy:

Index Fund (7% CAGR) → ~23 years

Bitcoin (30% CAGR, conservative estimate) → ~10 years

Bitcoin (60% CAGR, historical performance) → ~6 years

This is exactly the kind of comparison I'm testing with my own money. I'm starting with $3k in Bitcoin and documenting every move trading challenges, crypto plays, DCA strategy. I'm sharing all the real numbers and results in my newsletter as they happen.

But Wait, Isn’t Bitcoin Risky?

Yes. Bitcoin has had multiple –70% drawdowns in the past.

But the landscape is changing:

Institutional adoption (BlackRock, Fidelity, etc.)

Regulatory clarity (spot ETFs approved)

Shrinking supply (halvings, long-term holders)

Growing retail + sovereign interest

That doesn’t mean volatility is gone, but here’s what I believe:

I don’t think we’ll see those brutal – 80% crashes anymore. Never say never, but it's highly unlikely.

Why? Because more people, retail and institutions alike, are starting to truly understand the power of Bitcoin. Its scarcity. Its resilience. Its value.

This isn’t a fringe internet asset anymore. It’s becoming the monetary foundation for a new generation.

My Hypothesis: Bitcoin Can Accelerate Financial Independence

I’m not saying you should go all-in on BTC. I’m saying it’s worth considering as a core part of a FIRE strategy in this new world.

That’s the journey I’m starting.

Financial freedom for common folk is still possible and Bitcoin might be the most powerful tool we’ve seen in decades to accelerate that journey.

FIRE With Bitcoin: The Plan I’m Starting

So how do you actually begin?

It starts with a simple, honest audit of your life.

Step 1: Know Your Numbers

Sit down and look at:

Your monthly income

Your actual monthly expenses

Where you can cut (without hating your life)

Then ask yourself: What’s the number I need to feel free? What kind of lifestyle are you truly comfortable with, not to impress anyone, but to live peacefully and on your terms?

Use the FIRE formula to calculate that number:

FIRE Number = Annual Expenses × 25

Step 2: Start Buying Bitcoin (DCA)

Once you know your number, you don’t need to overthink it.

Start buying Bitcoin monthly, a little at a time. You’re not here to time the market. You’re here to stack and wait.

Don’t get distracted by daily price swings. If anything, pray for lower prices. Because at $0.17M per coin today, this asset is still early.

There are only 21 million BTC that will ever exist. Owning even 1 full coin will be a flex few can claim in the future.

Step 3: Track Progress in BTC, Not Just Fiat

Here’s where Bitcoin really flips the FIRE model.

Traditional FIRE says: "Save 25× your annual expenses in fiat."

But what if you instead said:

“I want to accumulate 1 BTC.”

“Or I want 0.1 BTC per year.”

“Or I want $X in fiat denominated in BTC terms.”

This shift will change the way you measure wealth. You’ll stop thinking about dollars, and start thinking in freedom units.

Step 4: Earn More to Stack More Sats

Here's the truth nobody talks about: saving $200/month extra is great, but making $2,000 extra is 10x better.

This is what I'm doing right now:

Trying to pass a $100k trading evaluation

Looking for crypto plays and investments

Testing different ways to earn more money that I can convert straight to Bitcoin

I'll be writing about every strategy I try the ones that work, the ones that fail, and exactly how much each one nets me in BTC terms.

Because let's be real, the fastest path to financial independence isn't just cutting expenses it's increasing income.

Step 5: Reduce Expenses, Increase Runway

Every dollar you save is a month off your timeline. If you can reduce spending by just $200/month, that could mean shaving years off your path to financial independence, especially if that $200 is going straight into Bitcoin.

My Plan (Documenting It Live)

I've started this journey with $3k in Bitcoin. I'm cutting expenses, running trading challenges, and testing every strategy I can find to earn more money that goes straight into BTC.

I'm sharing updates in real-time not because I've figured it all out, but because I'm figuring it out as I go. The wins, the losses, the strategies that work, the ones that don't.

This is happening live. I want to show what's actually possible when someone commits to this path.

Closing Thoughts

You don't have to go all in. You don't have to be a maxi or sell everything you own.

But you should consider this: "Everyone buys Bitcoin at the price they deserve."

Start with what you can. Build conviction over time. And maybe… just maybe… this little internet asset changes your whole future.

Summary

FIRE = Financial Independence, Retire Early

You calculate it: Annual Expenses × 25

You reduce spending + increase investing

You buy Bitcoin regularly (DCA)

You stop waiting for permission and start building freedom

This isn't financial advice. This is a theory. A blueprint. A bet on what the future could look like.

P.S. I'm documenting my entire journey from $3k to financial independence in real-time.

Every trading challenge result, every crypto play, every strategy to earn more and convert it to Bitcoin.

I'm sharing the actual numbers, wins, and failures as they happen. If you want to follow someone actually doing this (not just teaching theory), subscribe here